Eightcap is a renowned global trading platform, especially in the Australian, European & Asian regions. We are talking about a platform that has been operating for over 12 years, being one of the pioneers in the Forex industry.

However, things have changed a lot since its launch in 2009. The regulatory licenses have been updated and the product listing is constantly growing.

Considering these developments, it might get challenging for the platform’s potential users to decide – Will it be a good choice as a Forex broker to trade? In this Eightcap review, we will tell you.

After reading this detailed Eightcap Review till the end, we are sure you’ll get a clear & better idea of whether choosing it as your trading companion is a good decision. The review will be based on detailed scam analysis report, fee and product offerings.

What Is an Eightcap Broker?

Eightcap is an Australian brokerage company founded in 2009 that initially specialised in Forex trading but gradually expanded to offer a much wider range of markets, including Stocks, Indices & commodities, which are now traded under CFD format.

The broker operates as three different entities registered in all major jurisdictions – Eightcap Pty Ltd (Australia), Eightcap Global Limited (Bahamas) and Eightcap International (Saint Vincent and the Grenadines).

The broker has won several Industry Awards, including ‘Best MT4 Forex Broker Global 2020’ for its advanced trading platforms.

At the same time, As far as the platform’s working is concerned – As a CFD broker, Eight Cap offers trading platforms through which traders can place their trade orders. For these services, it charges specific fees & commissions.

Is EightCap Regulated?

It is a legit trading platform, considering its multi-regulations & existing users’ reviews. Registered in the Bahamas, the platform regulates in three other jurisdictions worldwide with a company number registered under the company name EightCap Global Limited with license number (ABN 73 139 495 944).

The Australian Securities & Investments Commission (ASIC) regulates the Australian entity with license number- (AFSL 391441)

The Securities Commission of The Bahamas (SCB) regulates the Bahamas operation with license number- (SIA-F220)

Saint Vincent, and the local jurisdiction, supervises the Grenadines entity.

Overall, these heavy regulations exceed what many brokers offer and show how seriously Eighcap takes your trading experience.

What Trading Instruments Does Eightcap Forex Broker Offers To Trade?

There are over 800+ underlying assets available for trading on the platform. And as per our evaluation through Eightcap Review, the product offering is way too exceptional compared to other online CFD brokers on the market.

Some of the major financial markets available for trading on the market include:

Forex

- 40 major and minor currency pairs

- EUR/USD

- USD/JPY

- USD/CAD

- USD/CHF

Commodities

- Oil Crude -WTI

- Oil Brent

- Gold

- Silver

- Copper

Indices

- US30

- GER30

- SPX500

- NDX100

- HK50

Shares

- US Stocks

- LSE Stocks

- XETRA Stocks

- Australian Shares

Cryptocurrencies

- Bitcoin

- Litecoin

- Ethereum

- Dogecoin

- 100+ More

What Are Eightcap Fees & Brokerage Charges?

The platform doesn’t charge any commission on CFD trades; instead, there are spread charges and SWAP fees for positions that remained open overnight.

At the same time, the spreads vary depending on the account type chosen by the trader. The Eightcap fee for Standard accounts is comparatively higher than RAW accounts.

Let’s understand it more precisely through a table:

| Instruments | Raw Account(Lowest Spreads) | Standard Account(Lowest Spreads) |

| Forex | 0.0 Pips | 1.00 Pips |

| Indices | 0.2 USD | 0.2 USD |

| Commodities | 0.1 USD | 0.1 USD |

| Cryptocurrencies | 0.004 USD | 0.004 USD |

| Shares | $0.02 per Share ($4 per lot round turn) | $0.02 per Share ($4 per lot round turn) |

Commission – 3.50 USD per standard lot on the Raw account & SWAP fee also applies.

Our findings from Eightcap Review indicate the fees & other charges of the platform are slightly over the global industry standards. So, if you prefer low-cost trading, this might not be the perfect platform for you; instead, you should go with our best recommendation – TradeEU.

What is the Maximum Leverage Offered To Traders?

While its fee structure fails to make a mark, the platform’s leverage offering is reasonable. The leverage offering depends on the region you’re using the platform from. For instance –

- For Eightcap Pty Ltd, it’s 1:30.

- And for Eightcap Global Ltd, it is 1:500

What Account Types Does Eightcap Broker Offer?

Two retail investor accounts are available with the broker: Raw Spread Account & Standard Account. While researching for Eightcap Review, we found many similarities between the two, except for commission. While a Raw account incurs commission, Standard account holders are free from paying any commission.

Unlike other broker accounts, Eightcap offers a Demo Account with no minimum deposit.

Here’s a quick comparison table between the Raw and Standard accounts so you get a better idea of which one suits you better.

| Standard Account | Raw Account | Eightcap Demo Account | |

| Minimum Deposit | $100 | $100 | N/A |

| Average Spread | 0.5 – 1.8 pips | 0.0 – 1.0 pips | N/A |

| Commission | $0 | 3.5 USD2.25 GBP2.75 EURper standard lot traded | N/A |

| Margin Call Level | 80% | 80% | – |

| Minimum/Maximum Trade | 0.01 Lots/100 Lots | 0.01 Lots/100 Lots | 0.01 Lots/100 Lots |

| Stop Out Level | 50% | 50% | – |

| Scalping Allowed | Yes | Yes | Yes |

| Hedging | Yes | Yes | Yes |

| Expert Advisors (EAs) | Yes | Yes | – |

How Can You Open A Live Trading Account On Eightcap?

Opening an Eightcap live account is simple; it didn’t take long when we tried registering. However, the verification process may irritate you.

Here are the simple steps to open a live trading account in a few minutes:

STEP 1. On the homepage, Click the ‘Create Account’ icon.

STEP 2. Now, enter the general information, including country of residence, name, e-mail, password and mobile number.

STEP 3. After clicking on the ‘Create Account’ toggle, you’ll receive an e-mail.

STEP 4. Click on the verification link and verify your e-mail address.

STEP 5. Upon verification, the account activation may take upto 1 business day to process.

Read Bomb Crypto Review 2023

Deposits At EightCap

The brokerage platform offers a variety of payment methods for easy & convenient account funding. For new users, we have given all the information related to account deposits below through Eightcap Review.

How To Deposit Funds Into Your Account?

- Log in to the Client Portal area

- Click ‘Deposit’ from the menu and choose your preferred payment option.

- Follow the further instructions to complete the transaction.

Minimum Deposit

The minimum deposit requirement for placing a trade on the platform is fixed at $100.

Deposit Methods

- Credit/Debit Card

- POLi Payment

- Bank Wire

- BPAY

- China UnionPay (uPOP)

- Skrill

- Neteller

- Cryptocurrencies

- PayPal

- Worldpay

- Fasapay

- PSP (Virtual Account)

- PayRetailers

Withdrawals At EightCap

The withdrawal of funds from the platform is easy but a long process. The processing time ranges from 3-5 business days.

How To Withdraw Money?

- Log in to the Client Portal area.

- Click ‘Withdraw’ from the menu and enter the amount you wish to withdraw.

- Choose your preferred payment option.

- Follow the further instructions to complete the transaction.

Minimum Withdrawal

There is no set amount for withdrawal on the platform.

Withdrawal Methods

- Credit/Debit Card

- POLi Payment

- Bank Wire

- BPAY

- China UnionPay (uPOP)

- Skrill

- Neteller

- Cryptocurrencies

- PayPal

- Worldpay

- Fasapay

- PSP (Virtual Account)

- PayRetailers

EightCap Withdrawal Review

The withdrawal with Eightcap is convenient for both novice and experienced traders. It offers several withdrawal methods, which makes withdrawing easy and effective. There’s no minimum withdrawal limit, which makes it even more favourable.

How Efficient Are Eightcap’s Trading Platforms?

The Eightcap’s trading platforms aren’t as effective as it claims to be. Despite the MT4 and MT5 platforms’ availability, it lacks some basic functions. However, our findings from Eightcap Review show that it should be rated 3/5 stars. Anyway, let’s take a look at all the functions and features of the broker’s available platforms.

MetaTrader4 (MT4) – For Desktop & Mobile App

To use MT4 in EightCap, you must log in to the account. The broker charges no fees for using MT4 on its platform. You can use it while trading with your Demo Account as well. You can download it on your desktop or trade directly through the web.

- 9+ Chart timeframes

- 30+ Technical indicators

- Trading robots with access to Expert Advisors (EAs)

- 4 types of pending orders, 3 order execution types

- Real-time quotes in Market Watch

- One-click trading

- Historical data

MetaTrader5 (MT5) – For Desktop & Mobile App

Like, MT4, to use MT5 you have to login to the respective account. The platform is available on the demo account as well. You can download it on your PC or use the WebTrader for trading. The platform also offers mobile app downloads for quick and easy trading.

- 21 time-frames, 38 technical indicators

- Automated trading bots

- 6 types of pending orders, 4 order execution types

- One-click trading

- Advanced Market Depth

- Financial news

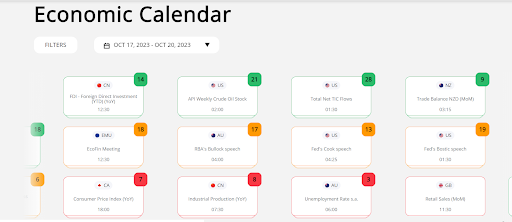

- Economic calendar

- Real-time quotes in Market Watch

- Historical data

WebTrader

- Easily Accessible Through Any Web Browser

- 21 time-frames, 38 technical indicators

- Automated trading bots

- 6 types of pending orders, 4 order execution types

- One-click trading

- Advanced Market Depth

- Financial news

- Economic calendar

- Real-time quotes in Market Watch

- Historical data

TradingView

- Easily Accessible Through Windows, iOS & Android Apps

- 21 time-frames, 38 technical indicators

- Automated trading bots

- 6 types of pending orders, 4 order execution types

- One-click trading

- Advanced Market Depth

- Financial news

- Economic calendar

- Real-time quotes in Market Watch

- Historical data

Insights Into EightCap’s Partnership Programs

Currently, the broker is running three main partnership campaigns. The bonuses are generous & payouts are quick. The ongoing programs include the following:

- White Labels

- Introducing Brokers (IBs)

- Money Managers

Code Free Automation

Eightcap allows you to utilise Capitalise.ai to develop, evaluate, and streamline trading strategies in plain English. With the broker, you can plan like a human and trade like a machine. You can automate your trade code for free.

AI-Powered Economic Calendar

The customised Acuity AI-driven big data engine of EightCap provides historical market impact and sentiment analysis to assist you in generating daily trading ideas based on over 1,000 macroeconomic events.

CryptoCrusher

Cryptocrusher is a dedicated dashboard to make your trading activity smoother.

To gain entry to Crypto Crusher, follow these steps:

- Establish a live trading account with Eightcap if needed. Click the CryptoCrusher tab to initiate the account creation process.

- Maintain a minimum account balance of $500 or more.

- Make sure to execute at least one trade each month.

What About Educational & Research Support?

The educational & research support offered by the broker is somewhat the best experience of trading with it. While creating this Eightcap review, we were really very focused on how it deals with beginners. And to our surprise, the availability of these tools makes it the best platform for beginners. So let’s take a glance at its offerings.

Educational Support

- Trading Guides

- MetaTrader Guides

- Fundamentals

- Trading Strategies

Research Support

- CFD News

- Market Updates

- Forex News

- Webinars

- Capitalise.ai

- Cryptocrusher

- Forex VPS

Customer Support

Here’s how you can contact Eightcap Customer support:

Asia

- Live Chat

- Phone Number: +61 3 8375 9700, +61 3 8373 4800

- E-mail: [email protected]

Australia

- Live Chat

- Phone Number: +61 3 8375 9700, +61 3 8373 4800

- E-mail: [email protected]

Europe

- Live Chat

- Phone Number: +61 3 8592 2375

- E-mail: [email protected]

LATAM

- Live Chat

- Phone Number: +61 3 8592 2375

- E-mail: [email protected]

Canada

Live Chat

Phone Number: +61 3 8592 2375

E-mail: [email protected]

You can also visit their physical address on different locations-

Australia

The Rialto, South Tower, Level 35/525 Collins St, Melbourne VIC 3000, Australia

Bahamas

208 Church Street, Sandyport, Nassau, The Bahamas.

Saint Vincent and Grenadines

Suite 305, Griffith Corporate Centre, PO Box 1510, Beachmont, Kingstown, Saint Vincent and the Grenadines

How Good Is Eightcap’s Customer Support?

The broker’s customer support is pathetic; firstly, it is available 24×5, and the representatives don’t answer accurately and quickly. We really had the worst experience with the support team. Online live support is no less than a hassle.

Final Verdict On Eightcap Review 2023

This detailed Eightcap Review shows the broker is a good choice for both beginner & professional traders. In fact, it offers a good selection of underlying assets, advanced trading platforms, rich educational support and free deposits & withdrawals.

However, the platform lacks good customer support, investor protections, high account minimums & low security. These are the top factors you should consider while choosing the best broker. So, we recommend you opt for a better alternative to Eightcap, i.e., TradeEU. The platform offers the best trading conditions, low fees and 24×7 customer support.

FAQs

Is Eightcap A Trusted Broker?

The Eight Cap is a trusted broker, considering its multi-regulations & existing users’ reviews. Registered in the Bahamas, the platform regulates in three other jurisdictions worldwide, such as the Australian Securities & Investments Commission (ASIC) regulates the Australian entity. In contrast, the Securities Commission of The Bahamas (SCB) regulates the Bahamas’ operation, Saint Vincent and the Grenadines entity is supervised by the local jurisdiction.

What Can I Trade On Eightcap?

There are over 800+ underlying assets available for trading on the platform from all major global markets, including Forex, Indices, Stocks, Commodities and Cryptocurrencies.

Is Eightcap A Market Maker?

Yes, the broker is a market maker as it offers the best trading conditions any trader would need to place successful trades.

Is Eightcap Free?

No, the platform charges specific fees through spreads and commissions. The typical spreads start from 0.5 – 1.8 pips and commission charges start from 3.5%.

Is Eightcap A Legit Broker?

Yes, the broker is legit as it is regulated by the Australian Securities & Investments Commission (ASIC), the Securities Commission of The Bahamas (SCB) and Saint Vincent and the Grenadines.

How Do I Withdraw Money From Eightcap?

- Log in to the Client Portal area

- Click ‘Withdraw’ from the menu and enter the amount you wish to withdraw.

- Choose your preferred payment option.

- Follow the further instructions to complete the transaction.

Does Eightcap Allow Scalping?

Yes, the broker allows scalping and hedging strategies on the platform.

Who Owns Eightcap?

The platform is owned and operated by Eightcap Global Limited, a registered firm in the Securities Commission of The Bahamas (SCB) (SIA-F220).

Is Eightcap An ECN Broker?

No, the broker is a Raw spread & CFD broker. It doesn’t offer ECN services.

Is Eightcap A Good Broker?

Yes, the broker is good in many ways, as it offers an extensive selection of underlying assets, advanced trading platforms, rich educational support and free deposits & withdrawals.

What Are The Spreads On Eightcap Products?

The broker’s typical spreads start from 0.5 – 1.8 pips and commission charges start from 3.5%.

How To Test Forex Trading At Eightcap?

You can test forex trading through the demo trading account available on the platform. You’ll have $50,000 worth of virtual funds to trade with.

Be the first to leave a review.