How to open an account with ABinvesting?

Opening an account on ABinvesting is easy compared to other brokers trading in the market. Thus, it makes the pattern and environment conducive for all users. A client has to sign up, for that matter. If you wish to seek advantage of the resourceful trading conditions and instruments on the broker, then create a trading account.

The broker offers facilities for accessing more than 350 CFD trading instruments, 60 analytical tools, customisable trading platforms and five categories of trading.

By creating an account on ABinvesting www.abinvesting.com, you are on the pathway to international arenas. For experiencing the bulls and bears of the market, you’ll have to follow some steps.

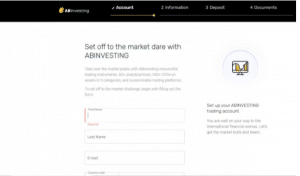

Step 1

The broker wants to recognise you. Thus, fill up important information which can help it create a data source.

- Fill in the first name

- Fill in the last name

- Write the personal email address

- Mention the country code followed by the country you stay in and want to trade from

- Protect it with a strong password comprising alphabets and numbers

- Click on the 18 plus option complying with the norms of the broker as people below that age are not allowed to trade

- Read entire terms and conditions before placing a tick

- Study the risk disclosure carefully

- If you wish to receive newsletters, product descriptions, the latest updates, special offers and other information, then place a tick on the second option.

- After that, click on create an account

- Your initial procedure is over.

- Now, you move on to the next one.

Step 2

- Now it is time to present the required information

- The broker may ask you to submit some other personal details

- Submit them and move ahead

- After submitting, you’ll get a chance to go further.

Step 3

The step is the most important one as it seeks deposits from users. It paves the way to show you the reality of the market. It clears the path to trade for you in the market.

- Connect the account with your bank account

- Submit the bank account details

- It will take some time

- Then, deposit the minimum amount for trading

- Once the deposit commences, you are ready to trade.

Step 4

For a detailed inspection and verification process, the broker needs documents.

- ABinvesting may ask for government IDs.

- You may have to submit a driving license, passport and other documents as IDs.,

- After the submission, the online brokerage company will take some time to verify it.

- Post the verification. You can start trading. However, you can choose to begin your days with the broker through a demo account.

How to get a Demo Account with ABinvesting?

The ABinvsting broker blesses traders with three primary accounts, including Gold, Silver and Platinum. Besides, there is an Islamic Account for Muslims. However, for people who are not comfortable investing or trading in the market and want to learn the nuances of the broker, then the brokerage firm offers them a demo account.

The demo account packs all features that of a real account. You get to experience a trading platform. You can get a feel of live trading with multiple assets at your disposal, trading account and virtual funds. Also, you can use different charts, indicators, signals, instruments and other services.

The broker gives a stipulated time of thirty days to understand the features and try them before investing in the real market. You can apply all strategies and apply the tricks to deeply understand the market gimmicks. The demo account presents you with all situations that you might face in the real market. There are fluctuations, swings, trendings and other situations, which help a trader to become better.

For getting to a demo account, you need to follow the procedure and register on the broker’s portal. After that, you get an option to chase your dreams through a demo account.

How to use a chart with ABinvesting?

For using a chart, a trader needs to have an understanding of the trading market. The broker offers three types of charts that are Line, Candlestick and Bar. These all can be used with the trading platform offered by the bludgeoning broker.

A price depicts the changes in prices of security with time. The requirement of the charts is to acknowledge technical analysis. It helps in knowing which way one should invest for garnering profits from the market. It also assists in testing. By using the MetaTrader4 platform made available by ABinvesting, you can open almost ninety-nine charts at one time on a terminal.

Bar chart:- For making a bar chart, one has to click on a button of the charts toolbar. You can open it directly by clicking ALT+1. The corresponding option is the chart setup window. The execution command is Charts- Bar Chart menu.

Candlestick chart:- One can open it by clicking a specific key or through accelerating way Alt+1. Then charts set up and the Charts-Candlesticks menu command.

Line Chart: It is a broken line connecting the bar with close prices. Again, one needs to click on a particular button or apply a shortcut; Alt+3. It is the corresponding option for setting the chart.

The broker has widely opened its horizon by offering traders these trading charts. They help in growing.

How to use leverage in funds for ABinvesting?

Trading is all about making funds and accelerating the economy. Leverage is the foundation for those people who do not have money but have skills and can do better. For those traders, ABinvesting offers the advantage of leverage. Here, they can borrow money and apply it while trading in different assets. Users precisely use it in the foreign exchange market because that is precise and on top of that, the volumes are enormous.

Thus, there are chances for bouncing back in the market at any point. The broker offers a maximum of 1:500 leverage to a Platinum Account holder while trading in the forex market. It means an abundance of opportunities for excelling in the market and getting showered by huge wealth.

For example, if someone has USD 500 in their trading account, and they trade with th Platinum Account, then he or she can use the leverage and borrow USD 250000 for trading. That’s a huge fund for participating in the fx market, which is highly unpredictable. However, with the help of experts and technical analysis, the success rate can be accessed in favour.

For a bigger chunk of benefits, one needs to look up to the market’s specification. It is important you pay attention to swings in the market and gain enough experience to anticipate the change.

How to deposit funds in the Abinvesting Account?

When a broker is ready, the first task one has to do is deposit at least the minimum amount of fund. After completing the formality, you are ready to experiment and see how it goes in your favour.

The broker empowers to challenge the growing financial market with tools and indicators. For depositing funds, ABinvesting provides a form of declaration.

- A trader should carefully read it and fill it.

- You’ll have to fill in your first name and last name.

- Here, you agree to engage with the broker and its parent company

- Moreover, you should first study the terms and conditions to shrug of any misunderstanding prior to depositing your funds

- You need to know about every minutest detail before conforming to what is written in the form.

- Here, you pledge to know everything about depositing.

- After reading it all and getting through consequences and other things, the customer places a signature and submits with the date to the broker.

Post that, choose any banking option lying on the broker’s website. You get the following option for depositing your funds:-

- VPay

- Skrill

- Neteller

- Maestro

- MasterCard

- Visa

Besides, you can look for other e-wallets and bank transfers like the wire transfer. Some premium or less or no charges may be applicable depending on which service you choose to deposit your funds in the broker’s account.

Interestingly, the accounts are segregated from corporate accounts to offer a sense of security to the depositor or a client.

How to contact customer care on ABinvesting?

For contacting a customer care representative, you must procure a valid reason. It will help you interact and escalate your matter further. The executives working with the brokerage firm are cordial and respond to your queries with all sincerity and professionalism. Their aptitude is to serve your concerns and address all your problems with the best possible answers.

For presenting your resentment and issues, the broker offers multiple channels.

Method 1

Write to the broker

The broker gives you a chance to write them all your problems regarding the market, technical things, trading assets, instruments or functioning of the brokerage portal, deposit or withdrawal of funds and other troubles. You can mention them all on a ‘write to us’ page. Fill in your first name, last name, email address, subject and the entire message with or without evidence. After that, click on the send button. Your work accomplishes there.

Method 2

Live chat option

Live chat is like an elixir for people who are finding it difficult to put their thoughts through another medium. You can begin chatting with a customer care executive by simply writing your name. Put down all your problems and chat freely until you get the desired solution. The executive patiently reads what all you write and arrive with the best remedy. That’s the strength and satisfaction you receive by using the method.

Method 3

Dial a phone call

The phone call method is the most viable and seems effective because you speak directly with the executive. There’s no hassle of writing and presenting your thoughts with the broker. You can speak and put your thoughts out there. The representative listens to you carefully and lets you express your concerns. Also, the person on the other side of the phone genuinely presents the best suggestions for making your trading experience better than ever.

The phone number of ABinvesting is:

+441214682461

Representatives are quick to respond, additionally.

Method 4

Email address

That’s another option thThe that can help you receive a swift response from the broker. There’s a dedicated team that handles it and views all mails received from users. They look keenly into matters and offer the required response that can resolve the issue.

Email address: – [email protected]

What is the procedure to withdraw funds from a trading account of ABinvesting?

The withdrawal of funds is a method laced with utmost importance. A trader is always concerned about money security because hackers are always looking to entrap them into committing a mistake.

The withdrawal policy favours the trader, which requests patience and guidance from the market player. Thus, you have to confirm some things.

- You can place the withdrawal request only via the official client area. Other ways are barred from using.

- To begin with, give your full name, including the last name that matches the trading account.

- The amount withdrawn by you should be less or equal to the balance present in the account.

- However, when the client has open positions, several other conditions or criteria need to be fulfilled.

- The free margin level must be beyond a hundred percent

- You don’t find any hedged positions

- Full details are used to withdraw and deposit funds.