Intraday trading refers to a system where you may enter and exit the trade within 24 hours. The holding period has to be contained within the trading day. Nonetheless, when you enter this system, you have to be mindful that, to be successful, you have to be dedicated, patient, and knowledgeable. There are several contenders for the best intraday forex trading strategy.

Intraday trading is its own space. By intraday, we mean ‘within the day. So when you hear of a new intraday high, you know that security has gotten to a high place relative to other prices in the trading season.

Let us look at the contenders for the Best intraday forex trading strategy. We will be learning about

- Trading forex on news releases;

- Open range breakout currency trading strategy;

- Momentum trading strategies.

Trading forex on news releases

There being a minimum of eight major currencies to be had for trading at a majority of forex brokers, there will always be some economic data meant for release. More than seven data items are released each working day. The said currencies are as follows:

- USD;

- EUR;

- GBP;

- JPY;

- CHF;

- CAD;

- AUD;

- NZD.

The most popular currency pairs are given :

- EUR/USD;

- USD/JPY;

- AUD/USD;

- GBP/JPY;

- EUR/CHF;

- CHF/JPY.

It is noteworthy that, given that the dollar is in 90% of all currency trades, US economic releases have the deepest impact on the forex markets.

Trading news is not to be underestimated. Besides the reported consensus figure, there are the whisper numbers – the unofficial and unpublished predictions – and reviews of preceding reports. You have to develop the insight to pick out the most important releases for your Best intraday forex trading strategy.

Key releases

When trading news, you must know which release to expect. The important stuff relates to changes in interest rates, inflation, and economic growth.

- Interest rate decisions;

- Retail sales;

- Inflation;

- Unemployment;

- Industrial production;

- Business sentiment surveys;

- Consumer confidence surveys;

- Trade balance;

- Manufacturing sector surveys.

Contingent upon the economy’s current state, the comparative importance of these releases may vary.

Best intraday forex trading strategy: news trading for forex mechanics

You have to search for a consolidation period of uncertainty prior to a big number. Then you can trade the breakout on the back of the news.

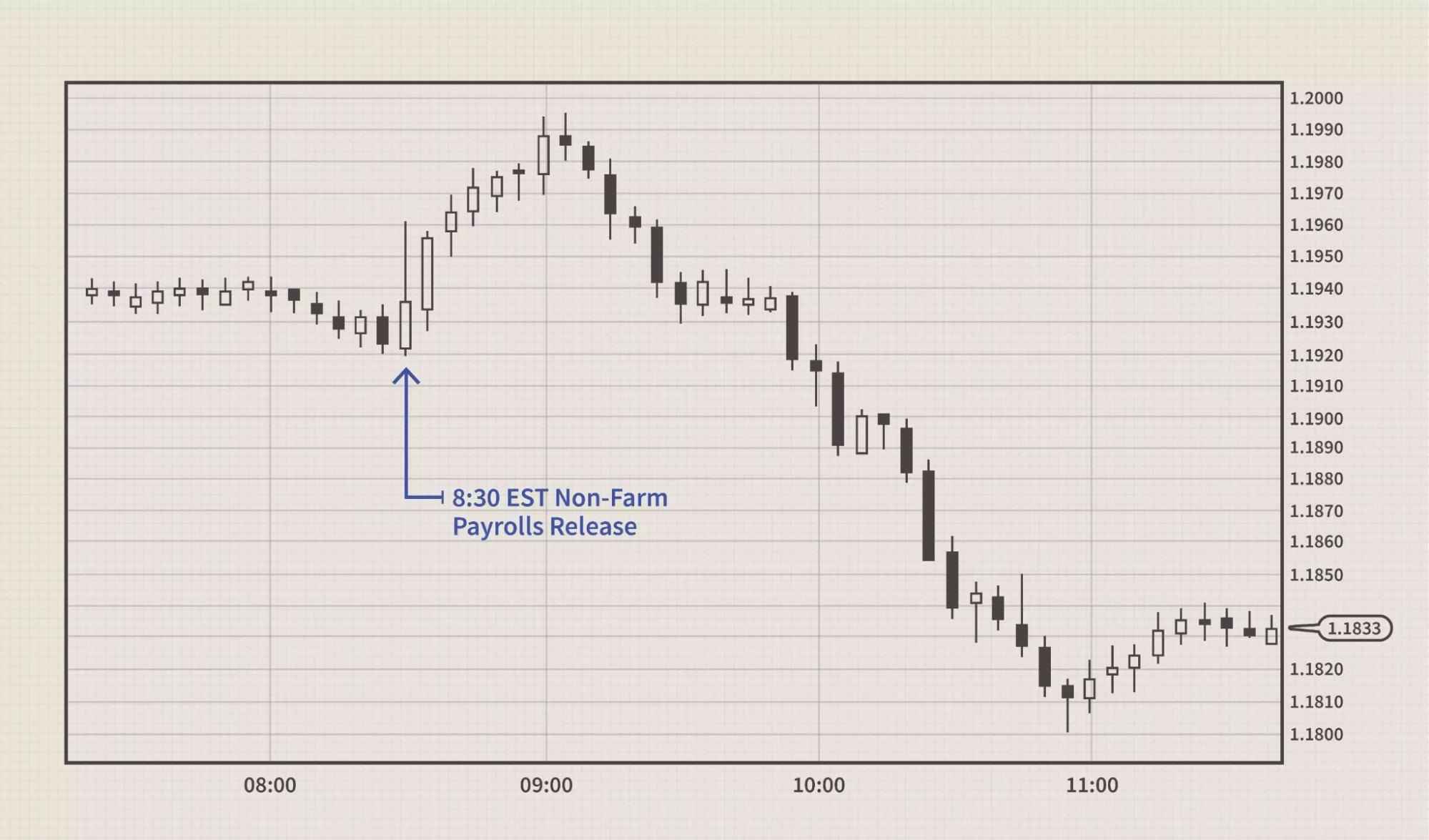

Per the chart, following a weak September number, the euro was pausing prior to the October number, slated for release in November.

Eur/USD was contained within a tight 30 pip trading range in the hours prior to the release. So there’s the chance to put on a breakout trade.

Not infrequently, there’s indecision and uncertainty right up the top of the October non-farm payroll numbers

The following chart shows activity after the news release, showing how complex trading such releases can be. When the market expected a payroll increase of 120000 jobs, the US economy gained just 56000 jobs. In the first 25 minutes post-release, there is close to a 60 pip sell-off in the dollar against the euro.

Nonetheless, the dollar’s upside momentum was also appreciable that there was a swift reversal. After an hour, the EUR/USD had ruptured the preceding low, touching a 1.5 year low against the dollar. Thus, there were a large number of opportunities for breakout traders. However, the dollar’s bullish momentum was very appreciable.

A significant bad payroll number failed to put brakes on the dollar’s rally.

While the worse than expected non-farm payroll number pushed the EUR/USD rate upward for a brief time period, the UDF’s strong momentum took over and pushed higher.

Exotic options news trading

A possible reply to grabbing a volatility breakout without the threat of having to face a reversal is trading exotic options.

As a rule, exotic options have barrier levels and will be profitable/unprofitable contingent on if the barrier level is penetrated.

Best intraday forex trading strategy could very possibly include these popular exotic options to trade news releases:

- Double one-touch option;

- One-touch option;

- Double no-touch option.

There Are two barrier levels to a double one-touch option. Either one of the levels has to be penetrated before expiration to make the opinion profitable, the buyer getting the payout. When neither barrier level is penetrated before expiration, the option expires unsung.

A double one-touch option is a great Best intraday forex trading strategy candidate. It is a raw non-directional breakout play.

Payout is assured as long as the barrier level is penetrated.

What about the one-touch option’s candidacy for Best intraday forex trading strategy? A one-touch option happens to have merely one barrier level. This, as a rule, makes it a tad bit more affordable relative to a double one-touch option. The same prerequisite applies. Payout is made conditional upon the barrier being penetrated before expiration.

A one-touch opinion is a great option to buy if you have a perspective on whether the number will be stronger/weaker relative to the market’s consensus forecast.

All in all, why are exotic options such great candidates for the Best intraday forex trading strategy? Currency options are a feasible alternative for those who wish to sidestep getting whipsawed by undue volatility. They would much rather see the spot price move in their direction.

The last option on this list is, too, a great Best intraday forex trading strategy candidate. A double no-touch option is a double one-touch option’s exact opposite. Despite the two barriers level, neither gets breached prior to expiration. The option payout is made only then.

The double no touch option fits those who believe the news release will not cause a marked currency pair breakout, and that it will keep ranging trade.

The open range breakout currency trading strategy: Best intraday forex trading strategy?

The whole intent of doing any form of analysis – be it technical, fundamental, statistical – is to attempt to identify higher probability trading opportunities. A recommended strategy is the use of a European opening range. The strategy will, as a rule, focus on EUR/USD, but it could equally hold true with respect to any European major.

The forex market, open all hours of the day (Eastern Time), witnesses the fluctuations in forex pairs’ activity. There are generally three major sessions:

- London

Open 3 am, close 12 pm Eastern Time;

- New York

Open 8 am, close 5 pm local time;

- Tokyo

Open 6 pm Eastern Time, close 3 am Eastern Time during winter; open 5 pm Eastern Time, close 2 am Eastern time during summer.

How does the open range breakout currency trading strategy work?

The essentials are the following :

Pinpoint the high and low during the half-hour just before London opens. Search for a breakout for the range +/- 10 pips or 1/10 of the daily Average True Range (ATR). You have to maintain above/below this level for 10-15 minutes. You are trying to identify the flow direction of the day’s remainder. From there, be careful to manage the bullish/bearish bias by concentrating on -, two-, or five- charts. You will be using a mix of moving averages – 13 SMA, 144 EMA, 169 EMA. The oscillators you shall be used shall include RSI, Stochastics, and CCI; other factors would include major news announcements and the time of day.

You have to jot down that you will be aware of the following:

Major option expirations –

New York expiry – 10 am local time

Japan expiry – 3 pm local time.

Currency fixings

London fix 4 pm local time

Tokyo fixes 8.55 am local time.

Currency futures

International Monetary Market closes at 3 pm Eastern Time;

US equity markets

It Opens at 9.30 am Eastern Time, close 4 pm Eastern Time.

In the best-case scenario, in the event of the price struggling close to these events – spottable with the aid of a bullish/bearish divergence, it could possibly be prudent to diminish the position size ahead of time. Furthermore, this approach may help reduce the emotional aspect of trading, given that the identifiable know where you are wrong. The identifiable area is the opposite side of the breakout’ high /low.

In action – Best intraday forex trading strategy?

Per this instance, EUR/USD makes a significant low during the 2.30 am to 3 am Eastern Time timeframe. This followed an RSI bullish divergence in price. The forex pair shot higher after. EUR/USD looks comfy, staying above the two minutes 144/169 EMAs. Conversely, the 13v period SMA stays above the EMAs. RSI keeps finding support into the key 40/45 zone. Resultantly, there is no cause to divert from the intraday bullish bias. Best intraday forex trading strategy, in order to be discovered, asks for a lot of dedication from you.

Time of day

Another factor to be mindful of is the time of day. Most London traders close their positioning between 11 am and noon Eastern Time. On the other hand, New York traders close between 4-5 pm Eastern Time. Correspondingly, price frequently sees a final end-of-day push. Profit-taking follows close to these times of the day.

Predictably, following 11 am Eastern Time, EUR/USD pushed higher once again to ultimately reach the intraday ATR target (1.2927). An RSI bearish divergence followed, just prior to noon Eastern Time.

Momentum trading strategies: Best intraday forex trading strategy?

Defining momentum trading

Momentum trading is concerned with the practice of buying/selling assets per the recent price trend strength. Provided there is sufficient force behind a price move, it will keep on moving in the same direction.

When an asset touches a higher price, it generally attracts more attention from traders, causing the market price to be pushed higher. This keeps recurring till a large number of traders enter the market. Sufficient sellers being in the market, the momentum changes direction, forcing an asset’s price lower. primeFin helps make sense of the market.

Momentum traders aim to pinpoint the relative trend strength in a given direction, subsequently opening a p[osition to take advantage of the expected price change. As the trend starts losing strength, they close the position.

Momentum depends on the following key factors:

Volume; volatility; time frame.

Volume

Volume is the amount of a specific asset traded within a given time frame. Volume is the number of assets traded.

Traders need to be able to enter and exit trades swiftly. A market with a high number of buyers and sellers is called a liquid market. ;

Volatility

Volatility denotes the degree of change in an asset’s price. In case a market is highly volatile, the implication is that there are major price swings.

Momentum traders take advantage of short-term appreciation/depreciation in an asset’s value. ;

Time frame

Momentum trading strategies generally concentrate on short-term market movements. A trade duration, however, can depend on the duration the trend maintains its strength. Hence, momentum trading fits traders using longer-term styles like position trading, besides short-term styles like day trading and scalping.

Momentum indicators: pointers to Best intraday forex trading strategy?

Momentum traders concentrate on price action. Hence, they depend heavily on technical analysis and indicators to decide when to enter and exit each trade.

-

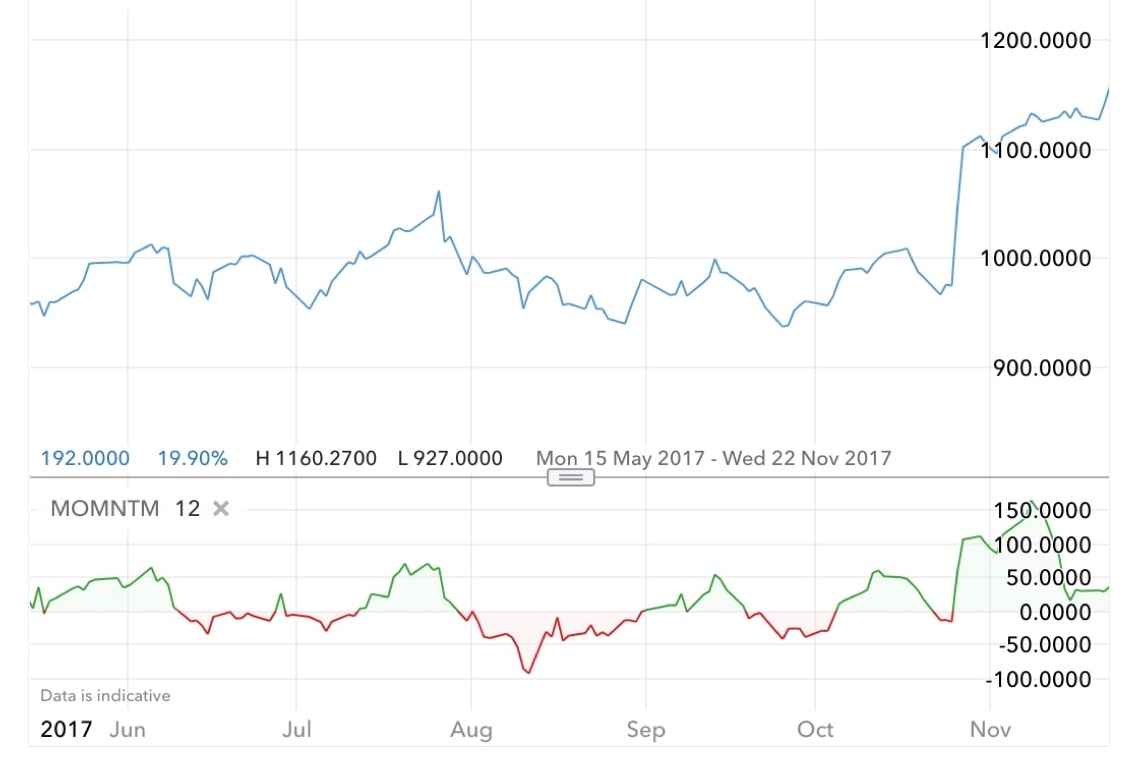

Momentum indicator

The momentum indicator takes the most recent closing price, comparing it to the preceding closing price.

An oscillator, the indicator is shown as a single line moving to and from a zero – centreline the indicator line’s value offers traders an idea of the pace of price movement.

For instance, if the indicator gives a reading of 35, that would be a faster uptrend relative to a reading of 30. Conversely, if the indicator offers a reading of -15, this would be a faster downtrend than a reading of -10.

Most momentum traders use this indicator to confirm price action. ;

-

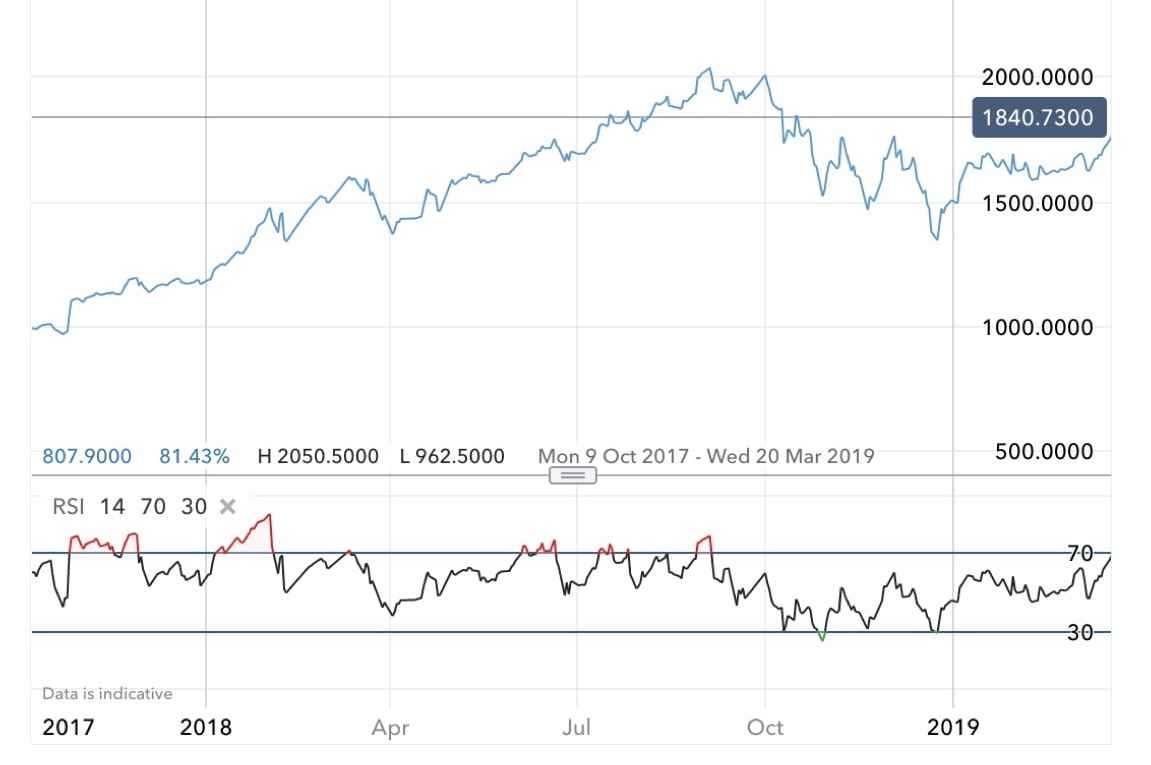

Relative strength index (RSI)

The RSI is a momentum-based indicator offering buy and sell signals. The indicator is an oscillator, moving between zero and 100.

The RSI offers overbought and oversold signals, contingent upon its value.

This momentum strategy depends on the notion that retracements between these price levels will show clear trends. ;

-

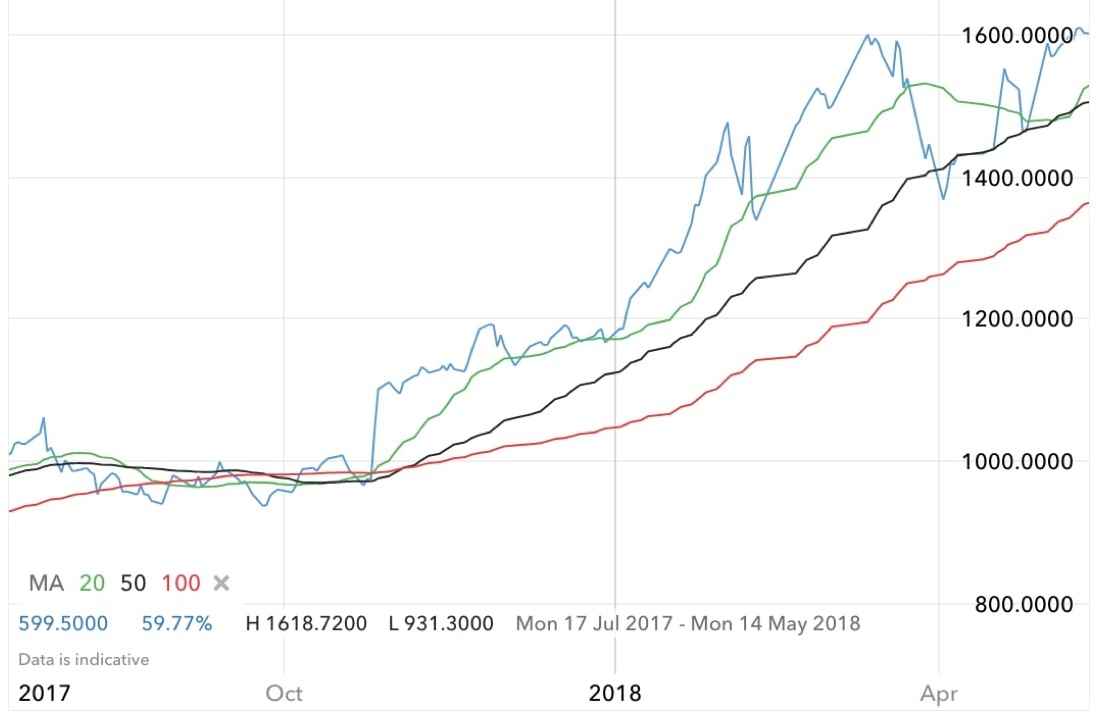

Moving Averages

Moving averages, notwithstanding the fact that they are not momentum-based indicators, help momentum traders see if a market is rangebound.

For instance, we see three moving averages applied – 15 days, 25 days, 35 days. For most of the price action, the moving averages are atop each other, the shortest MA on top and the longest on the bottom.

Per the info shown here, the market is trending. What’s more, the trend is accelerating. ;

-

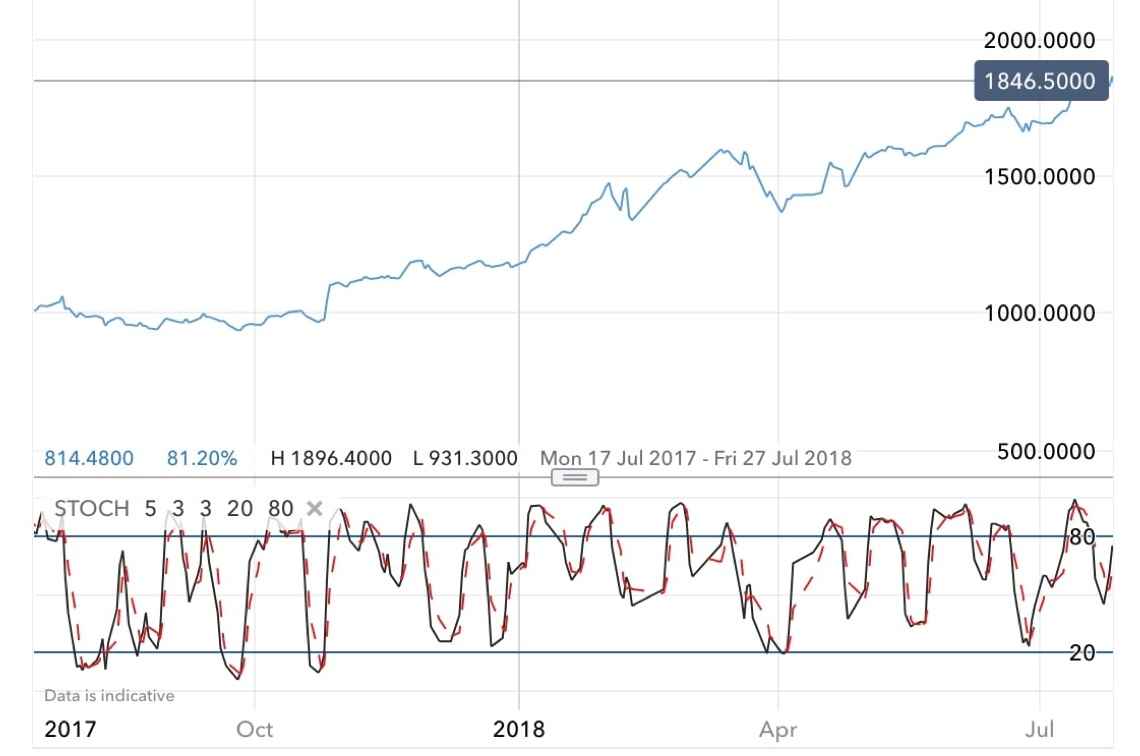

Stochastic oscillator

Over a specified time period, the stochastic oscillator compares the most recent closing price to the preceding trading range. The indicator concentrates on the speed and momentum of the underlying market.

The stochastic aids in forecasting price movements.

This indicator is comprised of two lines on a price chart:

-

Indicator line

A rangebound line oscillating between zero and 100. The market is overbought if the reading is 80+.

The market is oversold if the reading is -20;

-

Signal line

If the signal line and the indicator line cross, there’s a strong likelihood of changing direction.

When, during a pullback, the stochastic does not fall back to mark 20, this is interpreted as the trend continuing upward. For instance, we can see that the two lines generally have stayed above the oversold signal, the trend keeping on upward. So, notwithstanding pullbacks, the general momentum is up.

Conclusion

There are several intraday forex trading strategies. Not all are equally effective in all circumstances. Some strategies address specific concerns in situations where other strategies may be lack-luster. Seeing how useful these strategies are with your forex reading, we can recommend that you take up demo account trading with PrimeFin.